Welcome to Bacon, Eggs, and DeFi #034. Here's what happened yesterday in the world of DeFi!

DEXes:

Lending:

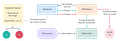

Aave released AMM Market, allowing users to use Uniswap and Balancer LP tokens as collateral. Users will be able to borrow DAI, USDC, ETH, wBTC, and USDT or lend DAI, USDC, ETH, and wBTC.

B.Protocol reached $60 million TVL.

Alpha Homora launched on Binance Smart Chain.

Cream Finance will add RARI as collateral.

Notional Finance shared its current Fixed Rate USDC borrowing rates.

Asset Management:

BadgerDAO will launch its Sett vaults to multiple other chains, starting with Binance Smart Chain and Polygon.

Enzyme Finance shared its roadmap, with deposits into Yearn Finance Vaults and the removal of asset limits coming in the future.

ETH deposited in Rari Capital is currently earning 28.2% APY.

Yearn Finance Vault APYs now show APY after fees.

dHEDGE’s performance figures will now reflect net after fees performance.

mStable will deposit 10% of its revenue into a MTA/ETH/mAsset LP on Balancer v1 after PDP15 passed.

Derivatives:

Yam Finance’s liquidity mining rewards for uSTONKS and uGAS are now live. For the next two weeks, LPs can earn 10,000 YAM and 10,000 UMA for uSTONKS and 10,000 YAM for uGAS (per week).

UMA launched a call option with UMA as the underlying token. Tokens in the first batch have a $35 strike price and expire on April 30, 2021.

APYSwap partnered with Hedget to allow Vault token holders to reduce impermanent loss through options.

Insurance/Security:

Mushrooms Finance will extend liquidity mining rewards on Cover Protocol through April 26.

Other:

Gnosis Safe announced SafeSnap, allowing off-chain governance votes to be executed on-chain. Multiple protocols, including Yearn Finance, Sushiswap, and Synthetix, will use SafeSwap.

Kraken users have staked more than 500,000 ETH on Ethereum’s beacon chain.

DFX Finance, DeGate, EulerBeats, Hxro, and PancakeSwap were added to DeFi Database.

DXdao announced DXventures, its internal investment fund for funding DAO-related projects.

Reading List:

Stay tuned for the next edition of Bacon, Eggs, and DeFi!